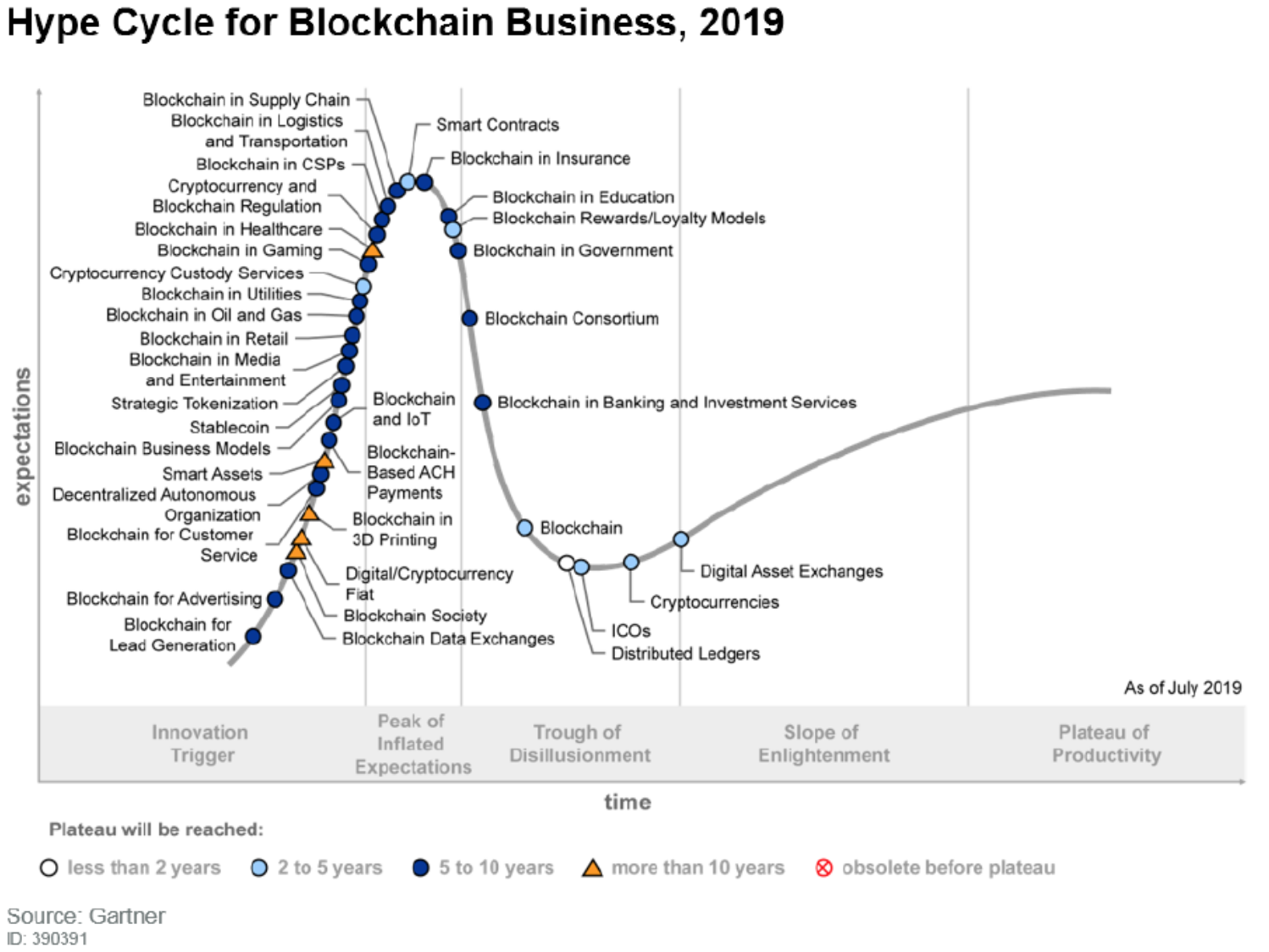

Recently, Gartner published the latest version of the Blockchain Business Hype Cycle. A good opportunity for us at Untitled INC to ask our distributed economy experts for their opinion. How do they evaluate the current trends and developments in the blockchain space? What is remarkable about Gartner’s estimation?

The result is an interesting and diverse insight into the current state of the blockchain ecosystem and industry.

Bearish on Supply Chain Solutions, Bullish on Custody Services

I agree with most categorizations of the blockchain hype cycle. But on a few points, I beg to differ.

At least in my bubble, expectations for the supply chain use case are significantly lower than they used to be, it feels like we are past peak here. Generally, I expect such use cases that rely on centralized oracles to not add much value to the economy. When data is added “manually” to the blockchain, it’s a utility killer – trustlessness is gone and hence its tradeoffs in terms of performance don’t justify using it over centralized databases.

The other point I would have expected to find at a different stage of the hype cycle is cryptocurrency custody services. While expectations might be high in the US, with players like Fidelity moving into the ring, in Europe it feels like few people are talking about custody (yet). This should change significantly with AMLD5 coming into effect in January 2020. As we are currently looking closely into the security token space with Liquiditeam, we realized that a solid custodianship infrastructure is much needed in the space, especially for tokenized assets.

Jonas Rubel, Co-Founder Liquiditeam, Head of Developer Relations Zen Blockchain Foundation, Member Untitled INC – Distributed Economy Experts

Telcos’ Expectations Not Inflated

“I like the comprehensive and at the same time comparative view of Gartner’s Hype Cycle. It’s good food for thought.

Looking at Communication Service Providers (Blockchain for CSPs) there has been a quite linear and consistent development over the last 2-3 years – from initial interest and building alliances towards PoCs, now moving closer to productization and even large scale rollouts as to happen in India very soon.

I wouldn’t necessarily say that expectations are inflated, unlike it is (or has been) the case in other industries like logistics and banking. There, the topic caught fire early, people got (over)excited, and then faced reality in a roller coaster manner. Telcos in contrast – after starting to ‘tinder’ – choose a very down to earth and systematic approach. They explored and tested a broad array of use cases, from carrier settlement, self-sovereign identity, payment and remittance towards offering ‘blockchain as a service’ solutions. Moreover, CSPs understand very well that this is an ecosystem game in which you shouldn’t walk alone.”

Dr. Karl-Michael Henneking, Chief Strategy & Investment Officer Batelco International Investments, Co-Founder Untitled INC – Distributed Economy Experts

Massive Implications for Banks

“To me, the most interesting data is that in the next 2 years 33% of the banking industry will adopt some form of blockchain technology. If the global banking industry is now worth over USD 135 trillion this means that there are potentially USD 44 trillion entering the sector. That is huge.

But still, I miss how ONLY 7,6% of the banking sector CIOs consider this technology a “game-changer“. Since the banking industry is heavily impacted by disrupting news like the recent transfer by Binance of USD 1,2 billion worth of coins at the cost of USD 0,015 in 1 second, it is either that most of the CIOs do not really understand what is going on or they are still “asleep at the wheel”. Either way, the implications for the banking sector will be massive.”

Andrea Bianconi, Lawyer Crypto Blockchain and the Law, CFO and Founder Thinkblocktank Association sans but Lucrative, member of Untitled INC – Distributed Economy Experts, blogger

Blockchain Favors New Organizations and Networks, Not Incumbents

” Here is Gartner’s Avivah Litan’s key takeaway from the new hype cylcle, as quoted on Techcentral.ie:

I don’t think we will ever see a revolution in the enterprise. No one wants to give up authority. Think about it. It goes against an enterprise’s ability to control their own destiny. Full, complete blockchain is about no central authority. It’s just peer-to-peer.

This strikes me as broadly correct, though I want to make two additional remarks.

I. In the enterprise world, blockchain is not for companies but for networks of companies. I expect that the next batch of successful blockchain-based projects will be in the b2b context, in what I have described as deep value networks before elsewhere:

These networks are designed to create, distribute, and exchange value (value networks) while tackling increasingly complex problems, markets, and ecosystems (deep networks). So far, the most successful networks have been consumer technology with a business model that relies on maximal adoption. Deep networks, in contrast, target smaller addressable markets which, however, provide a significantly higher value for and per participant (e.g. in terms of ARPU). These deep value networks can be consumer- as well as industry-focused — the latter presents a particularly interesting, high-upside playing field.

I stand by this evaluation.

II. Truly disruptive blockchain models will come from new organizations, not incumbents. The enterprise world is looking at blockchain and there is real potential, as by my point above. However, the truly disruptive innovations will not be created by established enterprises but new market entrants.

Of course, this can basically be said about almost all innovations. But in the case of decentralized cryptonetworks – where the truly disruptive potential lies – it is particularly tough for enterprises. Why? Because the entire organizational paradigm is almost the polar opposite of a traditional enterprise. Any incumbent who would want to get there would have to opt to, essentially, dissolve. Not impossible but very unlikely.”

Thomas Euler, Co-Founder Untitled INC – Distributed Economy Experts, Co-Founder Liquiditeam

Watch out for part two, with further analysis from our experts.