This is a brief summary of the round table my colleague Oliver Krause from Untitled-INC and me moderated at the Cube Tech Fair in May in Berlin.Let’s wrap up the round table in the form of a fictitious interview …

How was it overall?

In brief: Noisy and intense.

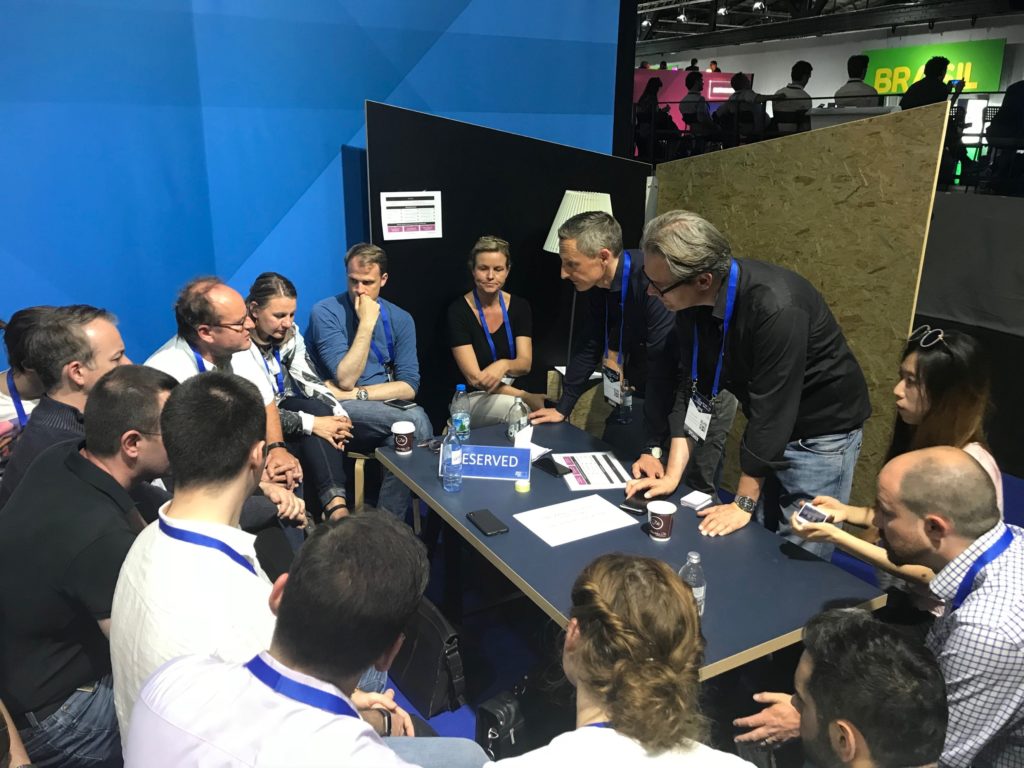

We had to ‘fight’ against the speakers on the main stage and I assume we successfully mastered the challenge – thanks to our engaged round table participants.

What were the main topics you discussed?

Well, the main points we discussed were:

- What makes a quality ICO?

- Why are most rating tools and methods for assessing ICOs insufficient?

- What can the crypto/ICO world learn from the VC and IPO world?

- Should ICOs be limited to true ‘crypto’ projects with a fully decentralized nature?

- Is there a future for utility tokens in light of increasing regulatory intervention?

- What are key future trends in ICOs?

And how did the discussion go?

Round tables are always people business. So, we as moderators were energized …

… and the participants were curious to listen and engage. We quickly got an active discussion going. As we were joined by people with very diverse backgrounds and experiences on the table – including ICO investors and people who had launched or were currently planning to launch an ICO – the discussion featured various interesting viewpoints and positions.

What were the main outcomes of the discussion?

In order to keep it simple, I’ll summarize the outcomes in seven points that hopefully reflect the essence of our discussion (in case you were present and think I missed something: please feel free to leave a comment below):

1) Many if not most ICOs are scams. Very few projects will be successful. And, just as in the dot.com times, there’s a lot of hype around card houses. What was rightly pointed out, though: in comparison to the Internet bubble, today’s ICOs operate on a completely new level of magnitude when it comes to risk-of-failure. We estimated that it is likely an order of magnitude higher, especially for less educated retail investors.

2) Accordingly, the market urgently needs more transparency and professional ICO assessment tools. In this context, we briefly discussed elements of the Untitled INC ICO360 framework[1] which integrates crypto, VC and IPO criteria into an investment decision.

3) Whitepapers as a primary information source are overrated. A whitepaper is more or less the equivalent of a pitch deck in the VC world, i.e. only one piece of the overall puzzle. To make an informed investment decision, a close look at other criteria is mandatory, such as the team, its experience, the project’s crypto economics, project risk factors and others.

4) Decentralization is attractive but it’s not a necessary precondition for an ICO and a large part of the investor community – shame on us, I know. Rather, the beauty of ICOs is that they open up the formerly closed market of investments in early-stage projects or companies to retail investors and make the assets easily tradable.

5) Step-by-step, utility token offerings will be replaced by security tokens. We couldn’t agree on a definitive timeline but some participants forecasted that the majority of newly issued tokens will be securities in 3 years from now (some people even claimed that it is only going to take one year).

6) So the future of ICOs will be securities. What else? Tokenization of assets is a hot topic right now. In this context, ICOs might pave the way for a new means of project financing for established companies – either by tokenizing existing assets or financing new asset-heavy development projects. Legally, however, that’s a very sensitive and complex topic. When we asked within what time frame a solid legal framework for tokenized assets would be in place, our roundtable participants were more conservative. One of them was even arguing that it might take a decade!

7) Overall: an optimistic outlook for the future of ICOs, although their nature, quality and legal compliance requirements will have to evolve.

Anything you wanted to address, but couldn’t during the talk?

Oh yes, we would have loved to spend more time on the opportunities and challenges of security tokens and the technical, legal and process requirements to implement them. And there is so much to say about ICO regulation, for instance regarding the status quo, trends and harmonization among jurisdictions. Also, asset tokenization is a topic which we at Untitled INC are currently having a deep dive into together with leading experts in this field. But no worry, we will keep these topics for another roundtable or share our thoughts in a publication.

A final word?

Sure. A big thank you to all the engaged roundtable participants. Thanks for having us Cube Tech fair. It was fun!

[1] ICO360 is a tool which we developed at Untitled-INC for ICO assessment and launch management, see www.untitled-inc.com

Author: Dr. Karl-Michael Henneking

Karl-Michael is passionate about digital incubation and transformation, the distributed economy and in particular dlt, blockchain, STOs and crypto regulation. He builds on an international career in consulting, CXO positions in tech companies and venture capital.